The Russia wheat market September 2025 is navigating a complex landscape. According to the latest CropGPT.ai report, record harvests are boosting supply, but rising export duties, sluggish shipments, and financial pressures on farmers are creating challenges. This article takes a closer look at the key trends shaping the Russia wheat market in 2025, drawing on insights from the SovEcon, IKAR, USDA, and the International Grains Council.

A Record-Breaking Harvest in Russia

Russia’s wheat fields are delivering in a big way. By late September, the country harvested 86 million tons of wheat as part of a 119-million-ton total grain haul. Full-year wheat production forecasts range from 85 to 87.5 million tons, with some analysts (like IKAR at 87.5M tons) projecting even higher totals as harvesting wraps up. This could push wheat output past 90 million tons, cementing Russia’s role as a global breadbasket.

Regional Highlights: Siberia and the Urals are posting record yields, though rains slowed progress. Stavropol (8.2M tons) has overtaken Rostov (7.6M tons, a decade-low due to weather) as the top producer.

Quality Check: Food-grade wheat (classes 1–4) makes up 77.6% of the harvest, with third-class wheat improving to 32.4% of the share—good news for millers and exporters.

Russia wheat market September 2025 production map

Russia Wheat Exports: Slow Start with Bright Spots

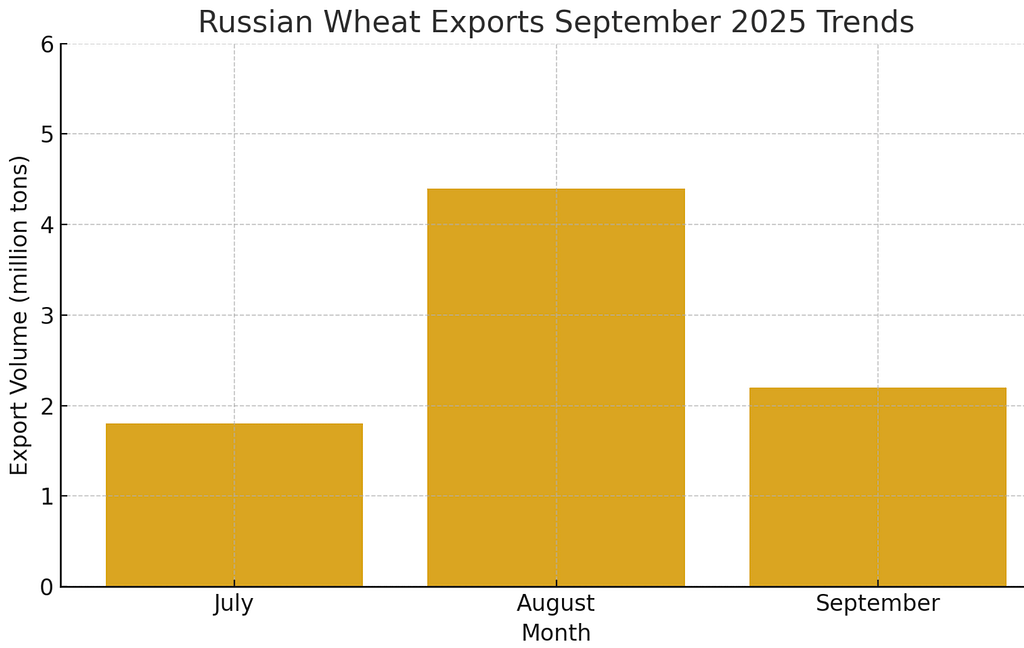

Despite the bumper crop, exports are off to a sluggish start. From July to August, Russia shipped 6.2 million tons of wheat, with 4.4 million tons in August alone. Key buyers included Egypt (1.2M tons), Turkey (0.66M tons), and Israel (0.38M tons), with Iran emerging as a major player, importing an estimated 2.2 million tons by September.

Export Forecasts: Analysts peg full-year wheat exports at 43–44 million tons (SovEcon: 43.4M; IKAR: 44.1M; USDA: 45M). Total grain exports could hit 53–55 million tons.

Price Trends: Export prices (12.5% protein, FOB Novorossiysk) ranged from $227–234/ton in September, rebounding to $228–229/ton on Iranian demand. Domestically, southern Russia saw prices climb above 15,000 rubles/ton (up 20% YoY), while European Russia dipped to 14,325 rubles/ton.

Export Duties: Russia’s floating export duties spiked from 134.4 rubles/ton (Sep 3) to 655.6 rubles/ton (Sep 24), before easing to 617.7 rubles/ton (Oct 1–7). These taxes, tied to global prices (~$226/ton), are squeezing margins and hitting farmers hardRussian wheat exports September 2025 trends

Russian wheat exports September 2025 trends

Global Demand for Russian Wheat

Global demand is mixed. Importers are waiting for Southern Hemisphere harvests, expecting potential price drops. Still, some regions show strong demand:

Africa: 7.9M tons of ag exports (mostly wheat) worth $2.1B in H1 2025. Egypt, Algeria, Libya, Nigeria, and Sudan account for 75% of this trade.

Asia: Bangladesh imported 0.2M tons by early September (after 2.8M last season), South Korea quadrupled imports to 156,600 tons (Jan–Aug), and China is expanding trade discussions on winter wheat.

See our 2025 Global Wheat Outlook for more on global supply trends.

Challenges: Weather, Policy, and a Hidden Crisis

Several factors are complicating Russia’s wheat dominance:

- Weather: Regional volatility—rains boosted Volga yields but hurt Rostov; Siberia experienced delays due to wet conditions.

- Policy Pressures: The Russian Grain Union warns of a “hidden crisis.” About 35,000 farms have gone bankrupt over five years due to high costs, duties, and market consolidation. Flour production is projected to drop 5.6% to 9.4M tons.

- Global Context: Russia holds 20–25% of the global wheat trade. Stable world prices limit upside, while Southern Hemisphere harvests could shift buyer preferences.

Russia wheat harvest 2025

What’s Next for Russia’s Wheat Market?

Looking to Q4 2025, Russia’s wheat output could exceed 90 million tons if harvest conditions hold. Exports face headwinds from duties and soft demand, but Africa and Asia offer growth potential. Longer-term, structural issues; farmer bankruptcies, declining machinery investment, and soil risks from crop shifts, need urgent attention.

For agribusinesses, traders, and policymakers, the takeaway is clear: the Russia wheat market September 2025 is a story of abundance and adversity. Staying agile, diversifying markets or hedging against price volatility, will be key.

Have an inquiry or question? Connect with the Medisca team by filling out our contact form, and we’ll arrange a meeting to provide guidance and next steps.